Dr. Michi Nishihara, Associate Professor, Graduate School of Economics

"Responding to changes and dynamically extracting investment and corporate values - Toward the establishment of mathematical models considering uncertainty"

Many companies select and invest in diverse projects to increase profits. How do companies evaluate a project’s value and invest in various projects? Dr. Michi Nishihara, an Associate Professor, focuses on investment by companies. His research is unique because it employs a new model future actions of companies under uncertainty, which is not possible with conventional models.

Dynamically calculating the project value with the Real Option Method

The NPV (Net Present Value) model is often used for business evaluations. This basic project evaluation method assesses profitability by subtracting business-related costs from future profits to be earned and converting the expected benefits into the current value. However, this method is somewhat insufficient as it cannot reflect all future possibilities.

“The future contains uncertain elements. For example, a project may be cancelled due to a recession. Conversely, the company may expand its business due to better economic conditions or to increase competitiveness, cooperate with other companies or sell part of its business. Therefore, project value must be evaluated after considering various options to deal with changing situations, including suspension, enlargement, and partnerships.”

Rather than simply calculating future benefits and costs to obtain the current value, the “Real Option Model” assesses options for different future situations, allowing companies to take optimal actions. In other words, the Real Option Method adds dynamic elements to the project value calculated with the NPV method.

Pursuing the essential corporate value

“The Real Option Method expresses future uncertainty using a certain stochastic process, building mathematical models, and theoretically predicting how a stochastic change affects the project value and eventually the corporate value. Namely, it indicates the conditions of the stochastic process where a business should be enlarged or suspended.” Thanks to this method, companies can improve the project value by dynamically considering optimal solutions according to situation changes.

“Nowadays, I am largely interested in analyzing the essential corporate value using the Real Option Method to understand the reasons behind the stock prices.”

Calculating information asymmetry

In an M&A, the acquirer often has difficulty evaluating the profitability of the M&A project due to insufficient knowledge about the acquisition partner, whereas the acquired side understands its situation well. This creates information asymmetry. Generally, companies are considered to take honest actions, but they may hide information within the legal framework to maximize profits. They cleverly decide by themselves what kind of information to disclose.

Dr. Nishihara also analyzes how such problems will be resolved. “If we include an information element into theoretical economic models, we see somewhat vulgar but quite human-like models in which people with information try to use it and those without information try not to be cheated. It is fascinating to mathematically analyze this information battle.”

Taking his research abroad

International collaboration is more important than ever in the field of economics research. Dr. Nishihara himself has experience performing research overseas and considers his stay at École polytechnique fédérale de Lausanne (EPFL) an invaluable experience. Not only do top-class professors in his research field work there, but each week, prominent professors from other world-class universities would visit EPFL and present their latest research findings at seminars, which allowed him to ask for advice regarding problems he was facing in his own research. In Japan, Dr. Nishihara reads up on the latest research findings in his field through published or working papers, which are typically delayed for a few years. In contrast, at Lausanne, he was able to learn about top-level research directly from the authors without any sort of delay. During his stay at EPFL, he was also able to attend a variety of conferences and seminars all over Europe due to the low cost of flights within the continent.

For further information on his work:

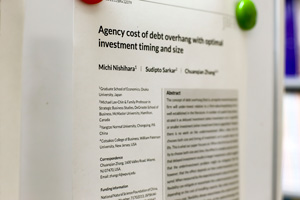

Michi NISHIHARA, Takashi SHIBATA, "Dynamic bankruptcy procedure with asymmetric information between insiders and outsiders," Journal of Economic Dynamics and Control 90: 118-137 (May, 2018, DOI: 10.1016/j.jedc.2018.02.006).

Michi NISHIHARA , Takashi SHIBATA, "Default and liquidation timing under asymmetric information," European Journal of Operational Research 263: 321–336 (16 November 2017, DOI: 10.1016/j.ejor.2017.05.038).

Text: Saori Obayashi/Edit: Christopher Bubb